In an autonomous finance function, processes and activities are partly governed and predominantly operated by self-learning software agents that optimise front-, middle- and back-office operations.

- Gartner client? Log in for personalized search results.

What is Autonomous Finance?

▶

▶

Why and how the future of finance is autonomous

An autonomous finance function is not just automated; it is capable of delivering augmented real-time and predictive insights, effortless compliance and greater flexibility in financial strategy.

But it relies on self-learning software agents and CFOs need a robust technology road map and a new mindset to effect this transformation.

Three CFO mindset shifts to achieve autonomous finance

- Experiment to realise value from technologies.

- Give autonomous finance as much credit as people.

- Advocate for autonomous finance technologies.

Building blocks of autonomous finance

Sixty-four per cent of CFOs believe autonomous finance will become a reality within the next six years. But finance leaders must focus their digital investments on the key building blocks.

- Data and Analytics

- Blockchain

- Artificial intelligence

- Cloud

- Digital talent

Deliver valuable insights, at speed

The value of data has never been clearer. Today’s organisations require more flexible means to manage and analyse their data to produce innovative and intuitive insights at or near real time.

Finance teams often struggle to create valuable reports and analyses because of a misalignment between finance’s approach and the business’s needs. Piecemeal investments in finance data and analytics have contributed to fragmentation, where data, tools and expertise exist in silos across the organisation. Common indicators of fragmentation include:

data experts and finance analysts speaking “different languages”;

new data being gathered without finance staff being made aware of its existence; and

best practices for using analytics tools failing to permeate across the organisation.

Within an autonomous finance function, finance delivers valuable insights to decision-makers, finds innovative ways to use analytic resources and connects business problems to the data to help inform better decisions.

Meet the demands the business faces now and will face in the future

Blockchain is a fundamental skill that CFOs need to master by 2025.

While blockchain implementation may not be a priority for CFOs currently, it is a critical component to the future of business and the finance function. Especially as CFOs face unprecedented economic headwinds, implementing blockchain is key to driving better, faster and smarter decision-making to meet the demands the business faces now and in the future:

- Information management.One of the core components of blockchain is a disrupted ledger, which allows for a more accurate and efficient flow of information inside and outside the organisation, in a way that is more easily verified. This creates better insights for the business and more prudent decision-making all in the foundation of trust.

- Reporting. A single source of truth is critical for operations across the enterprise. Blockchain provides that single source or ‘golden copy’. Visible transactions help with efficiency and collaboration, which prevent obstacles.

- Agility. We live in a dynamic world. Blockchain allows you to improve the agility of your organisation because it breaks down silos and creates a network-based system that operates as a fluid ecosystem. A top priority for finance leaders is to reallocate capital based on changing business needs. Blockchain provides real-time data to do just that: alter business cases, monitor investments, track transparency and stop/reallocate funds mid-cycle to drive the right digital enterprise strategies.

Build a competitive edge for the long term

By 2023, 50% of large finance organisations will use AI to create short-term financial forecasts.

AI promises to deliver new insights and automate finance decision-making, but the reality of applying the technology is a struggle. Finance leaders do not know how to identify the processes that will benefit the most from AI, leaving AI ambitions shelved in favour of other priorities and exposed to technical obsolescence as competitors gain traction.

It is critical to create a culture that embraces and trusts AI. CFOs must actively participate in strategic decisions about when, where and how much AI to use throughout the organisation, rather than just treating it as another technology in the stack.

Four key actions to drive AI success:

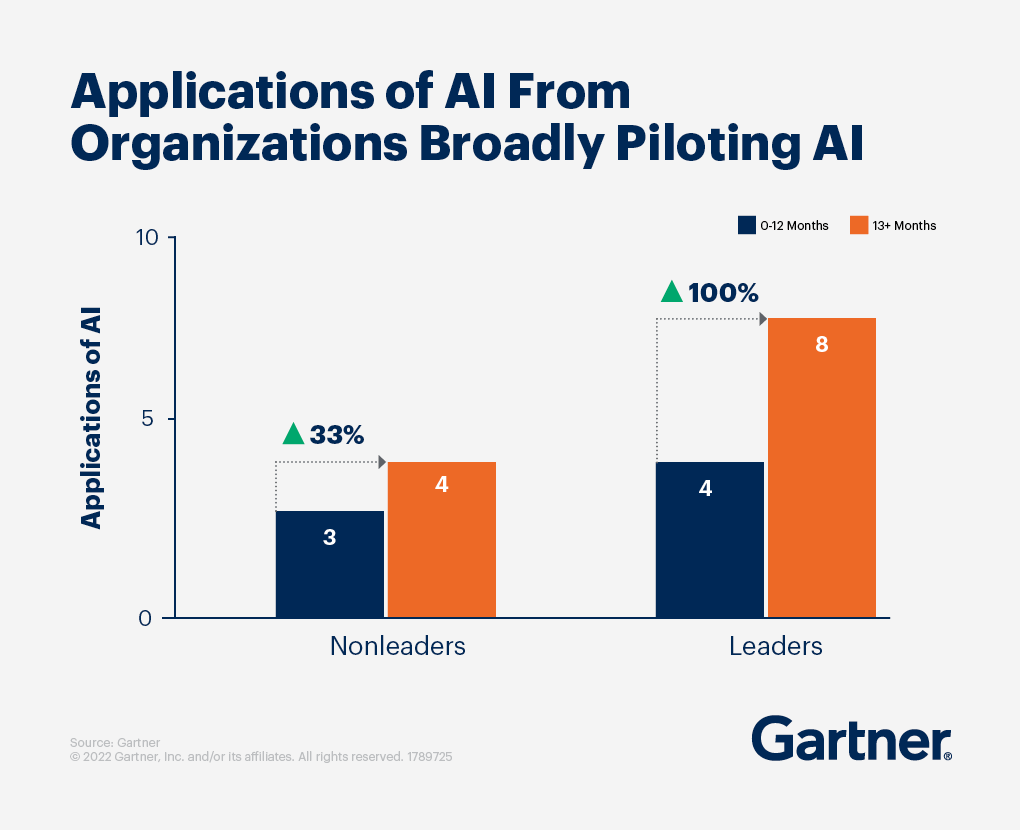

Leading AI finance organisations are not always the ones investing the most in AI, or the ones that have used AI the longest. Instead, they invest in specific ways or specific capabilities and more readily experiment with the following actions:

- Acquire new AI-specific talent.

- Purchase technology with embedded AI capabilities.

- Experiment broadly with the use of AI.

- Choose an analytically savvy leader to realise the benefits of AI.

Example AI use cases in finance:

- AI-enabled process mining algorithms capturing all variations and exceptions in procure-to-pay (P2P) and order-to-cash (O2C) in back office

- Virtual assistants processing transactions with machine customers and vendors in back office

- Machine learning identifying and organising data from various sources in a single place and enhancing the accuracy of information

Accelerate your time to market

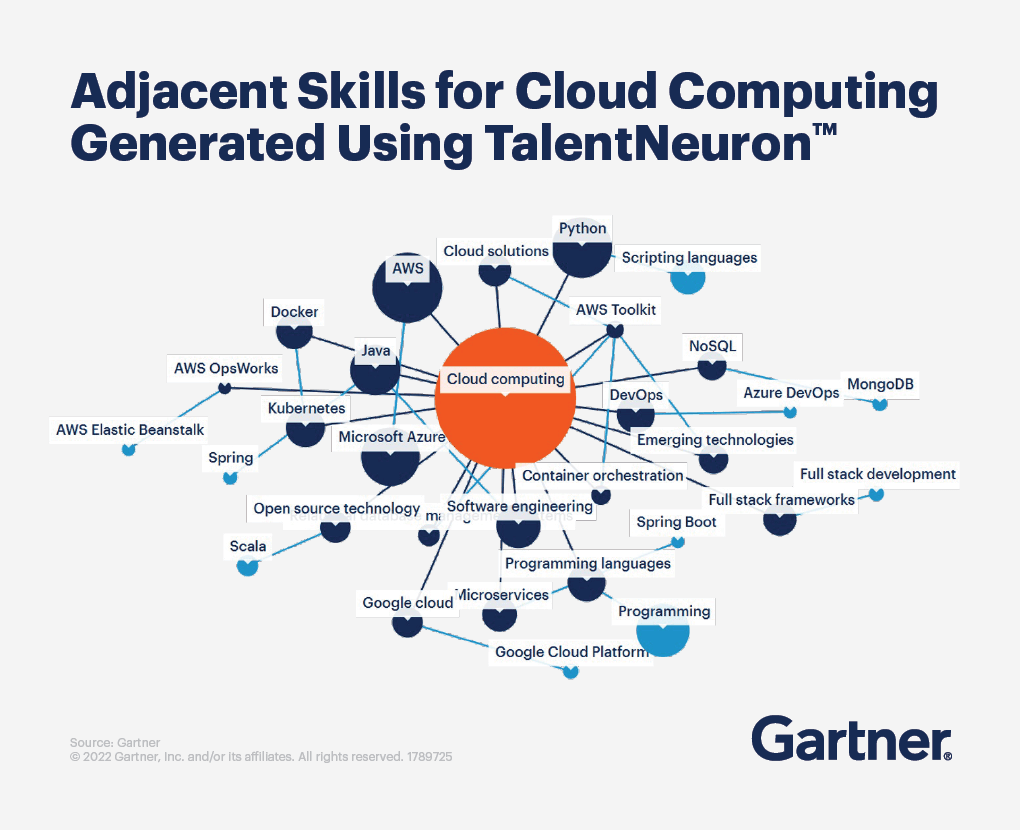

By 2025, cloud-native platforms will serve as the foundation for more than 95% of new digital initiatives, up from less than 40% in 2021.

Investing in cloud is a key building block for autonomous finance given the ability for continuous innovation, automation and faster value realisation. Cloud accelerates time to market with features and products that can scale and operate with less overhead. But despite the growth of cloud adoption in finance, it still significantly lags behind other functions.

Finance typically struggles to abandon existing technologies in favour of complete and immediate migration to the public cloud for two primary reasons: sunk costs (including unamortised costs still on the balance sheet) for on-premises systems and legacy system customisations, which slow the pace of migration to the cloud and often put the CFO behind the technology curve.

For organisations maintaining a combination of on-premises and cloud systems, building effective integration capabilities will be key in moving forward with cloud-migration plans, and ultimately, an autonomous function.

Bring strong skills and fresh ideas to the table

As autonomous finance initiatives ramp up, it is imperative to recruit the right digital skills across the finance team and throughout the business. But leaders face unprecedented talent challenges with competition for attracting and retaining employees. Plus, expensive talent is scarce, 47% of CFOs report it is difficult to find and hire enterprise talent. A more digital finance function may require rethinking the way the finance function is staffed and how roles are structured between finance and the rest of the organisation.

CFOs should partner with HR to define digital skills, bring them into the hiring process and rethink how to retain these skills. Among strategy, attraction, attrition and employee engagement, a digital talent strategy involves:

- developing critical digital skills. As data becomes more real-time and available to the business, it is critical to have decision-makers that have the appropriate financial IQ to leverage this financial data in a meaningful way; and

- redefining the employee value proposition (EVP).Rethink how to create a culture and sustainable environment for staff as the finance function becomes more autonomous. Think through the new work environment and use finance technology road maps to engage staff in helping to define and build a future state of the organisation.

Gartner CFO & Finance Executive Conference

Join CFOs and finance executives to learn how to navigate emerging trends and challenges. From peer-led sessions to analyst one-on-ones, you'll leave ready to tackle your mission-critical priorities.

frequently asked questions

What technologies for autonomous finance will transform the function?

An autonomous finance function uses technologies that move beyond traditional automation to include capabilities, such as self-learning and self-correction, and can make decisions based on the data they collect. These technologies have the potential to transform all parts of the finance function, from the back office to the office of the CFO. For example:

Back-office use cases include:

- AI-enabled process mining algorithms capturing all variations and exceptions in P2P and O2C;

- virtual assistants processing transactions with machine customers and vendors; and

- cloud analytics delivering analytics capabilities as a service, including a combination of database, data integration and analytics tools.

Middle-office use cases include:

- blockchain enabling an audit-ready continuous close;

- smart contracts enforcing accounting controls and intercompany adjustments; and

- machine learning identifying and organising data from various sources in a single place and enhancing the accuracy of information.

Front-office use cases include:

- decision intelligence powering financially savvy tactical and operational decisions; and

- predictive analytics, specifically driver-based revenue and cash forecasting, serving as the foundation for predictive planning and automated scenario-planning.

Office of the CFO use cases include:

- decentralised finance facilitating innovative options for raising capital and insuring against financial risk;

- natural language processing aiding better understanding of retail investor sentiment; and

- cryptocurrencies enabling the creation of immutable digital asset markets and driving revenue generation and payment flexibility.

How is autonomous different from automated?

Autonomous finance yields augmented real-time insights, effortless compliance and greater flexibility in financial strategy. It goes beyond an automated function in its ability to learn and take action without human intervention.

How can an autonomous finance function help with economic disruptions?

Gartner has been studying stand-out corporate performers since the Great Recession (end-2007 to mid-2009) and has found that the decisions and actions companies take heading into a downturn clearly correlate to whether they exit successfully. Unique economic headwinds complicate today’s operating environment but the differentiating decisions clearly hinge on digital. It is imperative for organisations to place the right digital bets at the right cost heading into a recession. This includes:

- managing resources and spend differently;

- developing a comprehensive but versatile digital talent strategy; and

- accelerating key digital and technology initiatives.

Autonomous finance offers many opportunities to those bold and strategic enough to pursue and accelerate this initiative.