As organisations pursue digital strategies, CFOs need a digital finance function to match. Here are five opportunities for CFOs to accelerate functional digitalisation.

- Gartner client? Log in for personalized search results.

How CFOs Build a More Digital Finance Function

14 April 2021

Contributor: Jackie Wiles

CFOs are squarely focused on digitalisation imperatives in 2021 — not just enabling enterprise digital ambitions, but making the digital finance function a reality.

Leaders expect to see a function that is leaner (with fewer employees), digital and data-driven

“CFOs are entering a period of significant transformation for finance, with new technologies readily available to help drive efficiencies and insights into business performance,” says Alex Bant, Chief of Research and Practice Vice President, Gartner. “For CFOs, the mandate is both digital catch-up — doing what they should have done before — and building back differently.”

Path to a digital finance function can be rocky

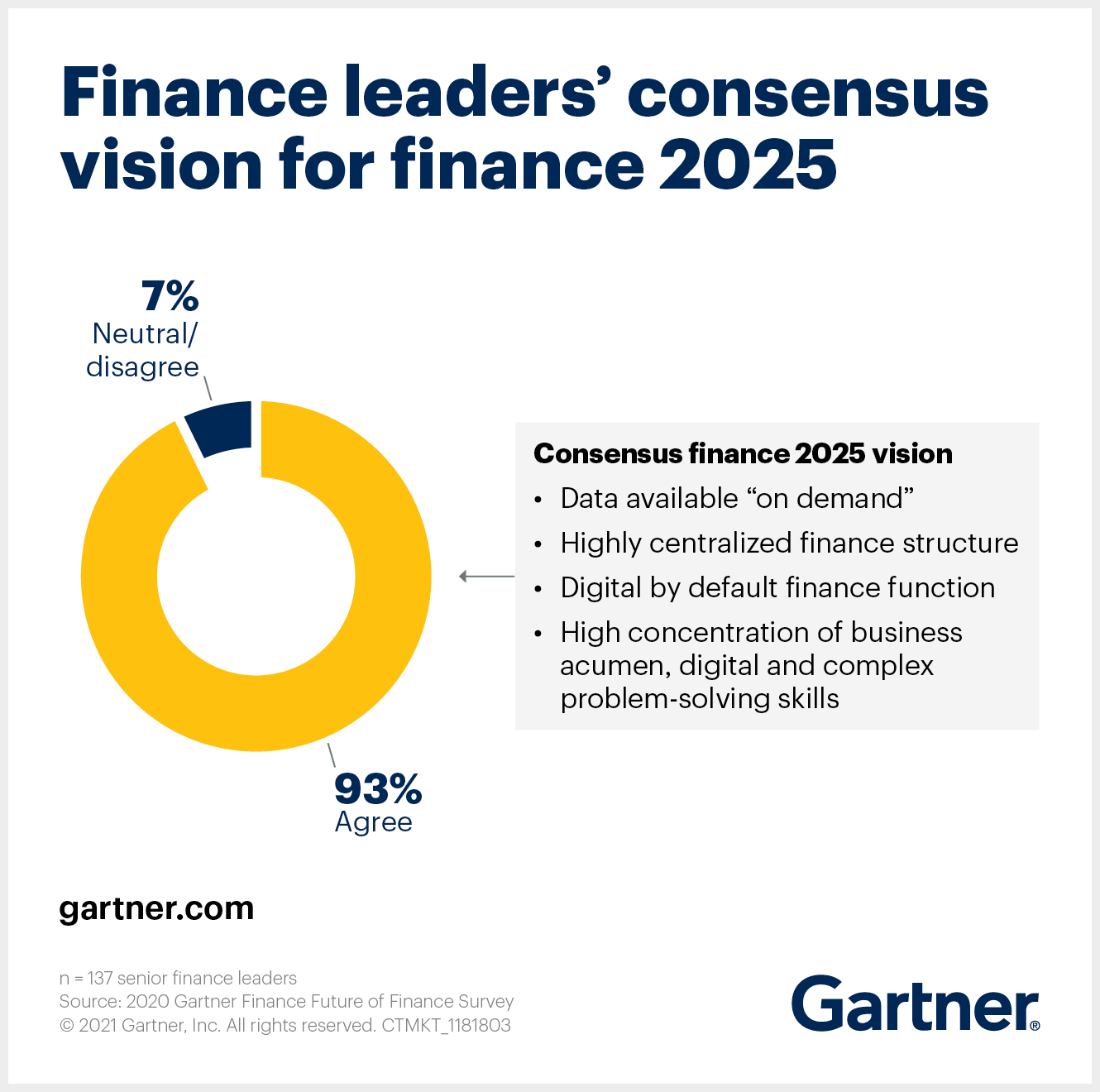

A recent Gartner survey showed that 93% of senior finance leaders were aligned on their vision for the finance function in 2025. Those leaders expect to see a function that is leaner (with fewer employees), digital and data-driven.

Leading CFOs recognise the importance of organising finance in line with these opportunities and are updating their functional strategies and organisational design accordingly.

Unfortunately, history shows that finance functions rarely transform successfully. Only 39% of finance leaders said that their previous transformation efforts delivered the expected benefits to finance; even fewer (36%) reported tangible benefits to the business.

5 opportunities to rev up the digital finance function

To accelerate the transformation to a digital finance function, CFOs must commit to specific initiatives likely to deliver value to the function and the enterprise. Here are five opportunities.

No. 1: Reduce waste and redundancy to free up capacity

Robotic process automation (RPA) has brought speed, efficiency and cost optimisation, but finance is still expected to increase decision support while reducing costs. CFOs must critically reassess the benefits of existing RPA programmes and ensure they are aligned to enterprise goals.

By adding machine learning, RPA can be used for more complex activities, such as budgeting and forecasting. This will free up relevant staff to focus on the most impactful decision-support aspects of their jobs.

No. 2: Invest in value-driving finance technology

Many organisations continue to run unwieldy finance processes using outdated technology. And less than one-third of CFOs are confident that their technologies are aligned to ensure the future success of the organisation. Finance AI is a critical next step toward hyperautomation, which enables automation of process orchestration, not just tasks.

By using additional technologies to automate complex finance processes, CFOs can focus on identifying new value-adding services, such as automatically forecasting long-term real estate value or predicting pricing based on consumer behaviour.

No. 3: Deploy data and analytics insights securely and at scale

Without the help of professional data scientists, finance is often challenged to generate insights that business leaders can use to make decisions. To unlock data and insights for the business at scale, CFOs can champion “democratisation” — providing a radically simplified data and analytics experience to finance teams.

A specialised team, for example, could leverage data augmented with artificial intelligence to facilitate data generation and preparation, and the discovery and visualisation of findings without the need to build models or write algorithms.

No. 4: Accelerate cloud adoption with right-size, right-choice vendor selections

Finance has successfully shifted key activities to the cloud, but increased scaling of processes is needed to support business imperatives.

Cloud service providers’ expertise in handling large volumes of data means they can better ensure data security than on-premises or private cloud solutions. The challenge for CFOs is to find the right vendors, at the right time, at the right price — and deploy solutions in places that will improve the speed, trust and predictive nature of insights.

No. 5: Hire, retain and develop digital skills in finance

Digital skills are needed to support an always-on, technology-driven, real-time business. But only one-third of finance leaders agree that their teams have sufficient competencies required for a digital finance function. CFOs must fill the growing digital skills gap in finance to improve the function’s ability to successfully exploit digital technology capabilities.

CFOs may need to change their approach to locating sought-after digital skills, because needs are changing so quickly. One option is an “always on” skills-sensing approach, working with HR partners to anticipate skill shifts as they are occurring — rather than trying to predict the future — and adapt to those shifts in an iterative, course-corrective way.

Related imperative: Driving digital transformation in the enterprise

Creating a digital finance function won’t be the only focus for CFOs in 2021. Most business leaders expect revenue to return to or exceed 2019 levels in 2021-22, and many expect the digitalisation of business and operating models to drive that growth. CFOs must fund those digital initiatives — while maintaining their organisation’s financial health.

Among the key initiatives for CFOs to accelerate the digital enterprise (business and operating models):

- Align digital strategies and business outcomes

- Design flexible planning and budgeting that can properly weigh the cost and value of digital initiatives in resource allocation decisions

- Rethink how to measure the performance of digital investments, which may fall outside the scope of traditional capital budgeting methods

![]()

You may also be interested in

Related Research

“I use Gartner to bolster my confidence in decision making.”

Stay smarter.